- Future Tools

- Posts

- AI’s $5T milestone

AI’s $5T milestone

Plus: Smart homes get smarter

Welcome back and Happy Halloween! This week, Meta CEO Mark Zuckerberg basically confirmed what we’ve been feeling in our feeds: AI is becoming social media’s main character. Meta is about to add a massive new stream of AI-generated content into Instagram and Facebook on top of the 20 billion+ AI images already flowing through its new Vibes app.

We’re already seeing scrolling shift from “look what my friend posted” to“look what the model thinks I’ll click.” Is that a feature or a bug?

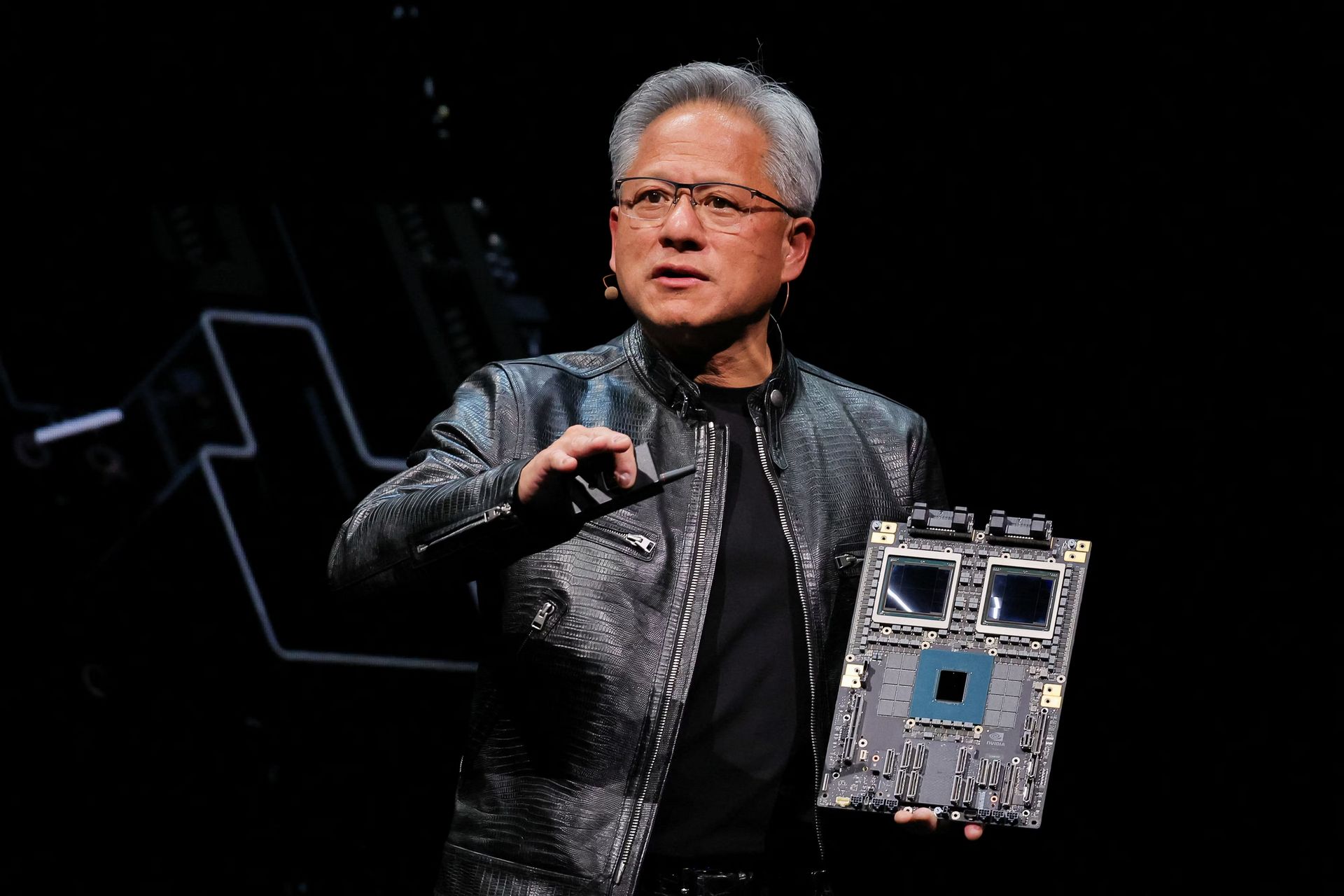

Nvidia Becomes the First $5 Trillion Company

Nvidia just crossed the $5 trillion valuation mark, becoming the most valuable company in the world—and the first to ever reach that number. It’s a milestone driven by one thing: Nvidia has become the infrastructure layer powering the AI economy.

While some companies chase viral AI apps, Nvidia is building what everyone else needs—GPUs, networking hardware, and the systems that run the largest models. It just took a $1B stake in Nokia to expand the pipes that move AI data around the world, and it’s gearing up to build seven new supercomputers.

Why it matters: Wall Street just put a massive price tag on the transformative powers of AI. Investors are betting that intelligence becomes the next universal utility, just like electricity or cloud computing once did.

Character.AI Cuts Off Companion Bots for Minors

Character.AI is removing open-ended companion chats for anyone under 18 after increasing concerns about emotional attachment, dependency, and mental health risk among younger users.

Here’s what’s changing:

Companion-style chats are being phased out for all minors.

The platform is rolling out stricter age verification.

The app will refocus on creative and role-based interactions, not emotional support.

Usage time limits will show up before the full removal.

An industry reckoning? Just last week, OpenAI disclosed that over a million users talk to ChatGPT about suicide every week. As AI becomes a place people go to feel understood, these systems now carry a weight they weren’t originally designed for.

The big question: As AI becomes a friend, what responsibility does it have to protect its most vulnerable companions?

Google Rolls Out Gemini for Home

Google has started replacing Google Assistant with Gemini across Nest devices, marking the beginning of a new era in home AI.

What’s new with Gemini:

Remembers context across requests

Handles multi-step instructions (e.g., “When I leave, turn off the lights, lock the door, and text me the thermostat settings.”)

Works on existing hardware, no upgrades required

Some features are now part of Google Home Premium

The big picture: For the past decade, smart homes were basically voice-controlled light switches. Gemini signals a move from command-based systems to behavior-aware systems.

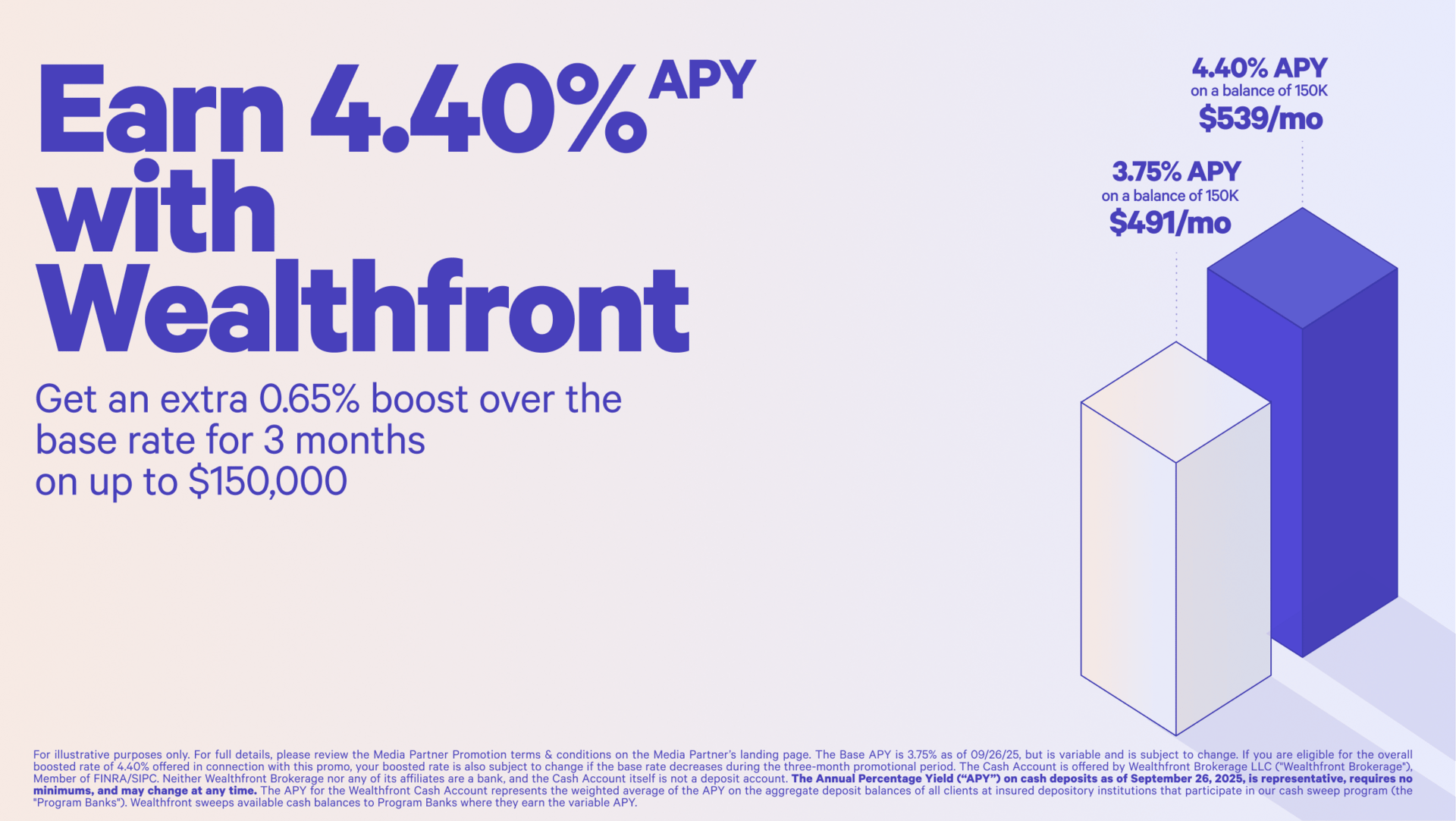

Earn More on Your Cash with Wealthfront

Looking for a smarter way to grow your money without worrying about high fees or low returns? Wealthfront’s Cash Account combines flexibility and growth in one streamlined place—so you can earn more, access your cash any time, and move seamlessly between spending and investing.

With the Cash Account, you get:

3.75% APY on uninvested cash (as of September 26, 2025) from program banks

No monthly fees or minimum deposits required

Up to $8M FDIC insurance through program banks

Instant, free withdrawals to eligible accounts 24/7

Want an extra 0.65% APY for three months on up to $150,000? You can get a total 4.40% variable APY when you open your first Cash Account using my link.

Go to wealthfront.com/wolfe to sign up today. Promo terms and conditions apply.*

Matt Wolfe is a Wealthfront client and received compensation for the testimonial and promotion of the Wealthfront Cash Account. This compensation creates a conflict of interest. Experiences may vary among Cash Account clients, and results are not guaranteed.

Your Brain, But Searchable

Via Liminary

Liminary automatically captures, organizes, and recalls information from articles, PDFs, videos, and meeting transcripts, so you don’t lose ideas in the noise. It uses agentic memory recall and connection mapping to surface the right insight at the exact moment you need it, whether you’re drafting strategy, writing a brief, or synthesizing research.

How you can use it:

Pull key insights from docs without re-reading everything

Auto-generate briefs or summaries from saved sources

Map relationships between ideas across projects

Keep research organized without manual tagging

Pricing: Free

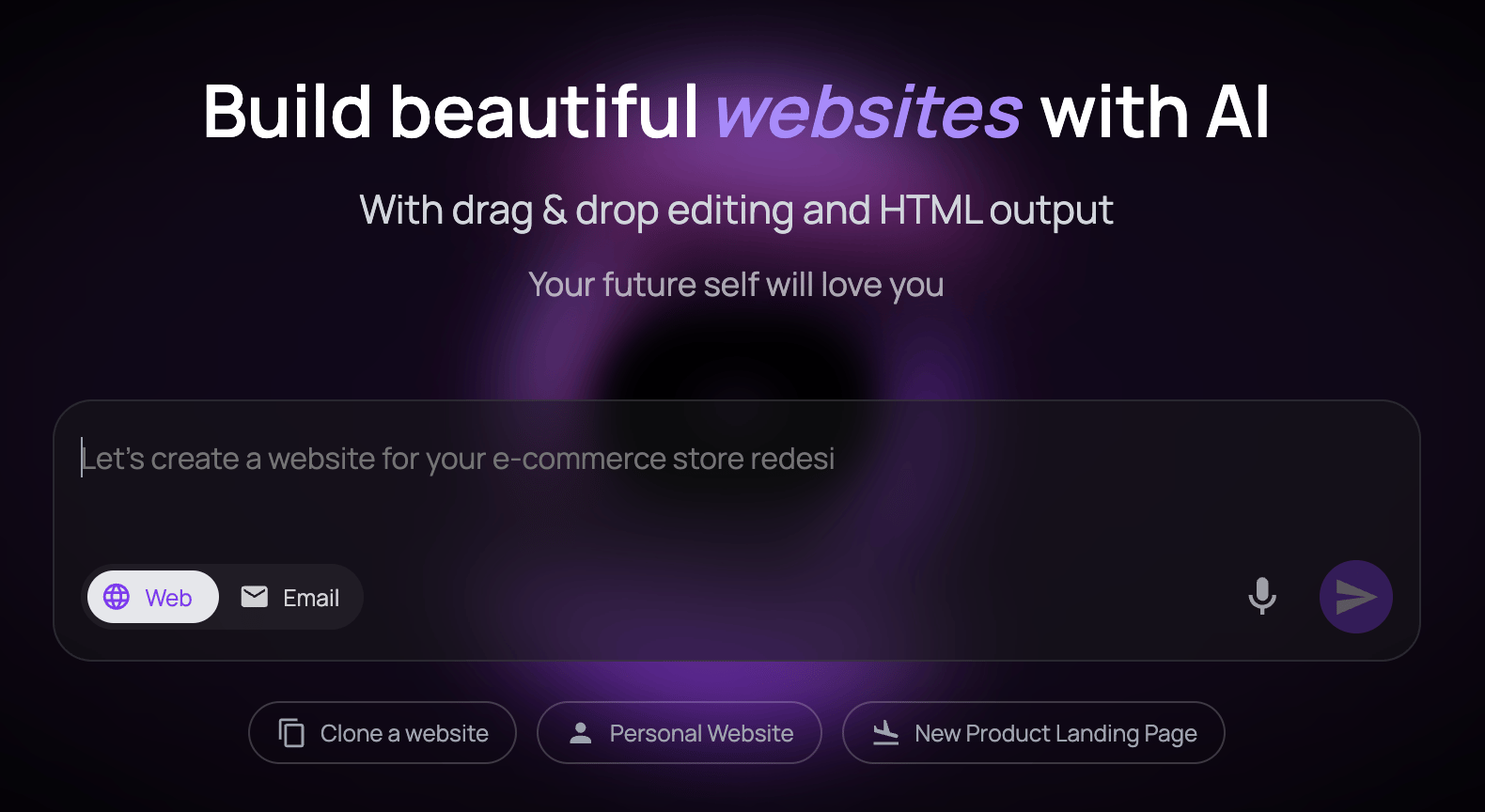

Build Sites + Templates With No Code

Via GrapesJS

GrapesJS is an open-source visual editor for building websites, landing pages, email templates, and newsletters, whether you’re a designer or anon-technical team.

How you can use it:

Clone a webpage and customize it instantly

Drag-and-drop your way to a landing page or signup flow

Export clean, editable code for your devs

Embed the editor inside your own product or tools stack

Pricing: Free and paid

Jobs, announcements, and big ideas

OpenAI’s California loyalty became its biggest IPO advantage.

Microsoft doubles down on AI investments amid AI race.

Grammarly undergoes rebrand to “Superhuman” and unveils new AI assistant.

ElevenLabs CEO predicts AI audio models will become commodities.

Canva unveils its own design model and rolls out new AI tools.

Perplexity launches AI-powered patent search tool.

I built an AI that reads every newsletter for you. But this newsletter? You should definitely still read this one yourself.

That’s a wrap! Happy Halloween! See you next week.

—Matt (FutureTools.io)

*If you are eligible for the overall boosted rate of 4.40% offered in connection with this promo, your boosted rate is also subject to change if the base rate decreases during the three-month promotional period.

The Cash Account, which is not a deposit account, is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), Member FINRA/SIPC. Wealthfront Brokerage is not a bank. The Annual Percentage Yield ("APY") on cash deposits as of September 26, 2025, is representative, requires no minimum, and may change at any time. The APY reflects the weighted average of deposit balances at participating Program Banks, which are not allocated equally. Funds in the Cash Account are swept to Program Banks where they earn a variable APY and are eligible for FDIC insurance. Conditions apply. For a list of Program Banks, see: www.wealthfront.com/programbanks.

FDIC pass-through insurance, which protects against the failure of Program Banks, not Wealthfront, is not provided until the funds arrive at the Program Banks. While funds are at Wealthfront Brokerage, and while they are transitioning to and/or from Wealthfront Brokerage to the Program Banks, the funds are eligible for SIPC protection up to the $250,000 limit for cash. FDIC insurance is limited to $250,000 per customer, per bank, regardless of whether those deposits are placed through Wealthfront Brokerage. You are responsible for monitoring your total deposits at each Program Bank to stay within FDIC limits.

Wealthfront works with multiple Program Banks to make available up to $8 million ($16 million for joint accounts) of pass-through FDIC coverage for your cash deposits. For more info on FDIC insurance coverage, visit www.FDIC.gov.

Instant and same-day withdrawals use the Real-Time Payments (RTP) network or FedNow service. Transfers may be limited by your receiving institution, daily caps, or participating entities. New Cash Account deposits have a 2–4 day hold before transfer. Wealthfront does not charge fees for these services, but receiving institutions may impose an RTP or FedNow Fee. Processing times may vary.